LED 1Q14 Price Remain Flat, says TrendForce

Apr 02, 2014

LED 1Q14 Price Remain Flat Despite Increased 4K2K TV and Lighting Demands, says TrendForce

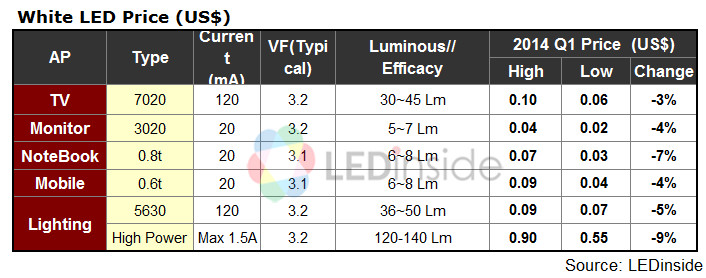

Lighting-level LED price declined 5-9% in 1Q14 as distribution channel inventory levels gradually returned to norm and manufacturers stock-up before Chinese May Day holidays, according to LEDinside, a research subsidiary of TrendForce. Backlight LED price dipped around 3-7%. Price declined steadily during 1Q14 compared to previous slack seasons.

COB gradually gains notice in LED market

“LED prices for lighting applications showed a continual downward trend in 2Q14,” said Jack Kuo, Assistant Manager of LEDinside. In terms of the main product developmental aspects in 2014, mid-power 5630 LED will remain mainstream for various manufacturers in 2014. The 3030 LED, 1W and above, is also going mainstream in the industry. Capitalizing on this, Korean manufacturers including Seoul Semiconductor and LG Innotek, have greatly expanded production capacity in 1Q14.

However, an increasing number of manufacturers have become optimistic about COB market development this year, including CREE and Seoul Semiconductor, who have already launched several COB products. Samsung that upholds a positive outlook for 3535 LED, has even begun mass production for the backlight industry in 1Q14. Samsung estimates that 3535 LED will enter the lighting market in mass between 2Q14 and 3Q14.

4K2K TV demand stalls as TV backlight market value drops

In terms of backlight application, 4K2K TV shipments increased 14% QoQ in 1Q14. There has been LED supply shortages for 4K2K TVs, said Kuo. Global 4K2K TV penetration rate will rise from 1% in 2013 to 8.1% in 2014, and TV shipment volumes are anticipated to be between 16 million and 18 million sets in 2014. LED TV penetration rate has rapidly increased to reach 99% and above, which will cause LED market value for large-sized backlight application to ease.

Chinese manufactures continue developing LED lighting and backlighting market in 2Q14

Over the past few years, Chinese LED manufacturers have been honing their craft. Manufactures have overcome lagging technical expertise by spending massively in headhunting talent from international LED manufacturers’ technical team to enter their production line and adjust manufacturing parameters. LED chips and package product quality have increased substantially as a result. Rising domestic demands have increased LED product acceptance rates in China. Currently, only high-end luminaire fixtures and products exported to Europe and the U.S. continue to use patented LED products. In addition, panels tariff could increase, which in turn will impact TV backlight supply chains. In order to keep cost competitive, Chinese TV brands are quickly increasing domestically manufactured LED product usage volume.

Source: LEDinside