Oil price-US dollar poser for airlines

Aug 31, 2015

Read More : http://www.nst.com.my/node/98350

Read More : http://www.nst.com.my/node/98350

As the old question goes, “Which comes first, the chicken or the egg?” It is the same rationale airlines are using when asked about the state of the local aviation industry, which is now sandwiched between low oil prices and a volatile ringgit, and their impact on overall costs, and ultimately air fares.

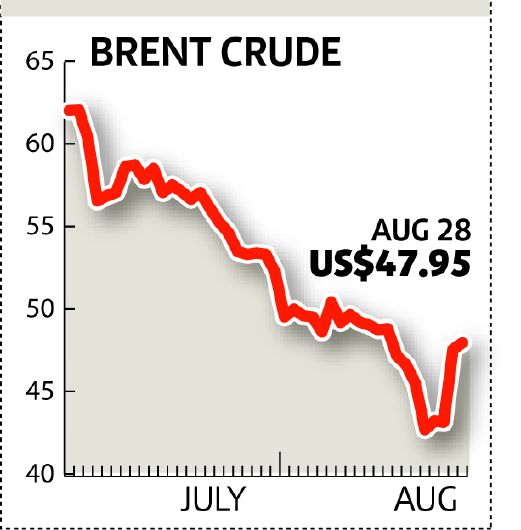

Oil prices have fallen around 60 per cent since the middle of last year due to slowing demand and rising supplies from countries such as the United States. This has been exacerbated by the Organisation of the Petroleum Exporting Countries’s decision against cutting output.

The global aviation industry is saving billions of dollars on fuel as the price of oil is at the lowest level in six-and-a-half years.

This has given airlines leeway to cut fares but, at the same time, still return healthy profits. Airlines had brought in larger, more efficient aircraft into their fleets while adding more seats to existing aircraft, analysts noted.

At printing time, the price of Brent oil stood at US$47.95 (RM202) per barrel, and if the past 12 months had taught us anything, it is that the price will remain volatile for the foreseeable future.

An aviation analyst said local airlines were unlikely to go through price restructuring this year.

“We will most likely see a restructuring of air fares early next year, but not this year. This is given that most people who want to travel typically buy their tickets ahead of time. The impact of the ringgit depreciation will only be felt next year as people stop buying tickets this year to travel next year,” he said.

“For this year at least, the airlines will try to maintain their existing prices and that in itself is challenging in these trying times,” the analyst added.

Industry players have their reasons for at least maintaining their fares.

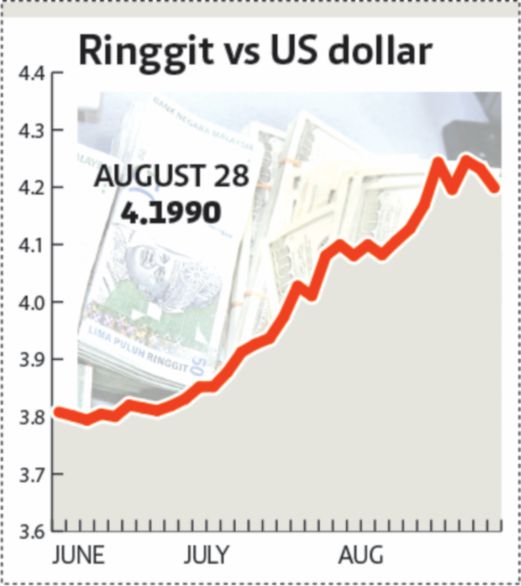

“It is a difficult time for Malaysia-based airline operators now that the ringgit keeps depreciating, while the cost of running an airline is still conducted in the US dollar,” said an industry player.

He noted that 60 per cent or more of airline operations, ranging from aircraft financing lease and jet fuel to aircraft insurance and maintenance are transacted in the dollar.

“The price of oil can keep going down, but it will hardly be beneficial to us if the ringgit keeps depreciating… but at the same time, airlines still want to retain their passengers.

“To increase ticket prices to cover the losses an airline makes would mean losing out passengers to a more competitively-priced rival. But again, to not raise the price would mean higher cost. It is the chicken or egg story,” he said.

“To increase ticket prices to cover the losses an airline makes would mean losing out passengers to a more competitively-priced rival. But again, to not raise the price would mean higher cost. It is the chicken or egg story,” he said.

The cost challenges that come from the volatile currency are also felt by short-haul carrier FlyFirefly Sdn Bhd, which is a Malaysian Airline System Bhd’s wholly-owned subsidiary.

“The lower fuel price is a boon to the aviation industry and Firefly has since earlier this year been the first local airline to remove the fuel surcharge due to lower fuel prices,” said chief executive officer Ignatius Ong in an email response to Business Times.

“However, we need to be also mindful that in any airline, many cost items are denominated in the dollar and with the current weak foreign exchange of the ringgit versus the dollar, we need to balance these cost escalation with savings from the lower fuel price,” Ong added.

An aviation analyst, however, said in the case of low price of oil and currency volatility, short-haul and domestic carriers were the clear winners.

“The irony of it all is that the year started very well for aviation players and many, such as FireFly and AirAsia Bhd, announced the removal of fuel surcharges and, thereby, reduced the travel costs. This was expected to raise travelling frequency and boost their bottom lines,” said the analyst.

“However, the sharp decline in the ringgit over the past few weeks had left these airlines revising the 2015 financial year expectations. That said, short-haul carriers that operate mainly domestically like FireFly will not be suffering as much as long-haul carriers like Malaysia Airlines,” the analyst explained.

AirAsia group chief officer Tan Sri Tony Fernandes looked at things differently.

“The currency situation that we are in is actually an opportunity for us. We see the opportunity to attract more people to fly. We don’t see a slowdown in our business,” he said earlier this month.

Fernandes also noted that AirAsia could expect to make some US$160 million in cost-savings next year from weakening crude oil prices as the group’s hedging tenure ends this year.

“Sixty per cent of the AirAsia fleet is hedged. Oil is a very big component of our costs and that has tumbled. No hedge next year as from the financial point, the currency devaluation is nothing compared with the oil devaluation. The devaluation of oil has a much bigger impact for us in foreign exchange terms,” he said.

AirAsia declined to comment on the matter when emailed by Business Times.

A SilkAir spokesperson, meanwhile, said it continued to monitor the market closely and would review its air fares to match market demand.

“Additionally, SilkAir regularly reviews the application of fuel surcharges and the last reduction of fuel surcharges was implemented in February this year.

“While fuel prices have come down in recent months, the fuel surcharge continues to provide only partial relief against SilkAir’s high operating costs from the price of jet fuel,” the spokesperson added.

Globally, fare wars are making a comeback amid lower oil prices.

Air New Zealand, for example, reportedly has fired some heavy shots in what is shaping up as an intense regional fare war.

Figures showed the airline slashing lead-in fares earlier this month just as Jetstar prepares to enter the market, according to the Herald last Sunday.

Air New Zealand has had a stranglehold on the regional aviation market for years and lead-in fares had dropped by up to 40 per cent on dozens of routes ahead of Jetstar’s announcement next month of where it will fly, the report said.

In the United States, American Airlines, Delta Air Lines and United Airlines are reportedly matching some of the discount fares offered by ultra low-cost carriers such as Spirit Airlines and Frontier Airlines.

Industry observers said fare wars were destructive to the global industry in the 1980s as airlines were focused on being the largest carrier on a route, even though it often meant losing money.

Today’s airline industry is more disciplined. So any fare wars should cause less damage yet offer much gain to travellers.

Source: New Straits Times Online