New Zealand Signals Rate on Hold After Cut; Kiwi Climbs

Dec 10, 2015

New Zealand’s central bank said its fourth rate cut this year should be sufficient to eventually return inflation to target, prompting a surge in the currency as traders bet Governor Graeme Wheeler has reached the end of his easing cycle.

“Monetary policy needs to be accommodative to help ensure that future average inflation settles near the middle of the target range,” Wheeler said Thursday in Wellington after lowering the official cash rate a quarter percentage point to 2.5 percent. “We expect to achieve this at current interest-rate settings, although the bank will reduce rates if circumstances warrant.”

Wheeler has now fully unwound last year’s tightening as the central bank forecasts inflation holding below the 2 percent midpoint of its target range for a sixth straight year. He’s reluctant to cut rates further as Auckland’s property boom spreads, posing a risk to financial stability, and economic growth shows signs of recovering from a mid-year dip.

“A cut was delivered, but it was of the hawkish variety,” said Cameron Bagrie, chief economist at ANZ Bank New Zealand in Wellington. “It now appears clear that the hurdle for additional easing is reasonably high.”

Kiwi Soars

The New Zealand dollar jumped after the statement. It bought 67.42 U.S. cents at 12:05 p.m. in Wellington from 66.47 cents before the decision. The currency has climbed 7.2 percent over the past three months, the most among 16 major currencies tracked by Bloomberg, muting price pressures.

“The rise in the exchange rate is unhelpful,” Wheeler said today. “Further depreciation would be appropriate in order to support sustainable growth.”

Wheeler cut rates in June, July and September before pausing in October, when he said it was appropriate to watch and wait.

Fifteen of 18 economists surveyed by Bloomberg forecast today’s decision, with two tipping the central bank would delay its cut until early next year and one projecting no further reductions. Financial markets were pricing a 70 percent chance of a cut, according to swaps data compiled by Bloomberg late Wednesday.

Further Cuts Tipped

Economists at ASB Bank, Capital Economics and Westpac Banking Corp. retained their forecasts that Wheeler will be forced to cut the benchmark rate to 2 percent next year despite the central bank’s forecast of inflation returning to its target. HSBC today changed its view and also expects another cut in 2016.

“The risks to inflation are all to the downside and the weakness in oil and global commodity prices really highlights that,” said Jane Turner, senior economist at ASB Bank Ltd. in Auckland. “We don’t believe this inflation track is achievable with a 2.5 percent OCR.”

The RBNZ today reinstated a three-year horizon for its forecasts of the 90-day bank bill yield, which it provides as a guide to the direction of the cash rate. The yield will fall from 2.8 percent this quarter to 2.6 percent by the third quarter of 2016 and stay there through 2018, the forecasts show.

Economic growth has softened in the second half of this year but recovering export prices, a recent lift in confidence and stronger demand as immigration fans population growth are expected to see activity strengthen in 2016, Wheeler said.

Growth Forecast

The central bank increased its forecast for net immigration, which it expects will stoke consumption and housing demand. It said the risk of an extremely low milk payout to farmers has decreased.

Gross domestic product will expand 2.4 percent in the first quarter of 2016 from a year earlier, the RBNZ forecast. That’s faster than the 2.2 percent predicted in September. Annual growth will recover to 3.1 percent in the first quarter of 2017, more than the previous 2.8 percent prediction.

Prices for dairy, the country’s biggest export, have stabilized after falling to a 12-year low in August. Business confidence has bounced from a six-year low and there was a lift in retail sales and manufacturing in the third quarter. Net immigration was a record in October and there was a 38 percent jump in tourist spending in the year through September.

Still, employment unexpectedly fell in the three months through September and the jobless rate rose to 6 percent. It is forecast to increase further, the bank said today.

Inflation Target

Inflation is expected to move inside the RBNZ’s 1-3 percent target range early next year as the weaker currency makes imports more expensive, Wheeler said.

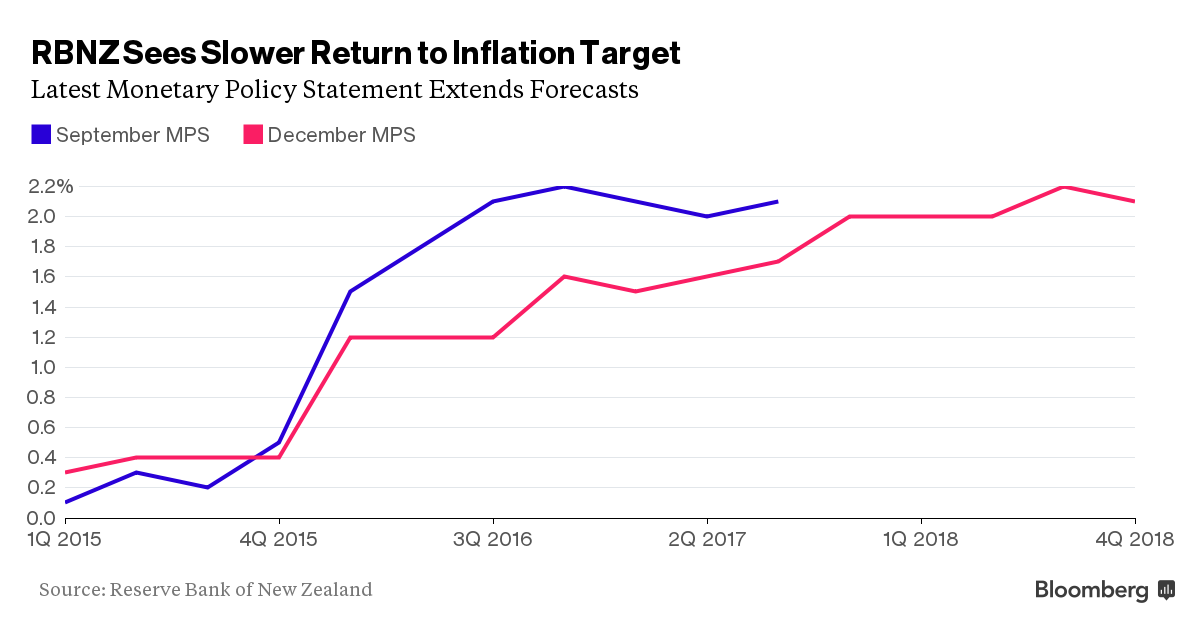

Consumer-price inflation will be 1.2 percent in the 12 months ending March 31, less than the 1.5 percent projected three months ago, the bank said today. Annual inflation was 0.4 percent in the third quarter this year.

Inflation will pick up only gradually and isn’t projected to reach 2 percent until the fourth quarter of 2017. Three months ago, the RBNZ expected it to reach 2 percent in the third quarter next year.

Wheeler lifted rates last year when strong economic growth, a booming housing market and record immigration suggested price rises ahead. While growth has slowed, the property market remains overheated.

House Prices

House prices rose 15 percent in the year through November -- the fastest in almost 10 years -- while in Auckland, home to a third of the nation’s 4.5 million people, they surged 24 percent. House-price inflation in Auckland remains high and poses a financial risk, said Wheeler.

The RBNZ introduced new measures aimed at Auckland residential property investors from Nov. 1, requiring them to have a deposit of at least 30 percent for a mortgage. The central bank has said it expects this to reduce the city’s house-price inflation by as much as 4 percentage points.

Source: Bloomberg